Just how hard has Covid-19 been on the magnetics industry and what lies ahead? In recent financial reporting, magnetics and electrical manufacturing industry companies have been quantifying their business declines during the pandemic and, in some cases, projecting the months ahead. This article summarizes the experiences and outlooks of several not previously covered.

Hitachi Metals, an $8 billion per year company based in Tokyo that is a major member of the Hitachi Group, reported that its overall business fell 34% in the three months ending June 30 while its segment Magnetic Materials and Applications/Power Electronics suffered a slightly less decline of 27.9%. Revenues for this segment were about $207 million compared to $264 for the same period a year ago, generating an operating loss.

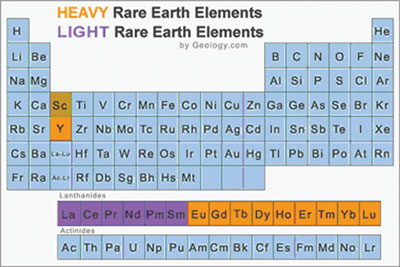

Breaking things down by business sector, Hitachi said that its sales of rare earth magnets among magnetic materials and applications decreased due to a decline in demand for various manufacturing equipment and industrial machinery as well as electronics-related products in the industrial equipment business in addition to a downturn in demand for automotive electronic components. Sales of ferrite magnets decreased year on year due to a decrease in automotive electronic components. As a result, overall sales of magnetic materials and applications decreased year on year.

Among power electronics materials, sales of soft magnetic materials and their applied products decreased year on year due to a decline in demand for amorphous metals for transformers, despite an increase in demand related to telecommunications such as server equipment. Meanwhile, sales of ceramic components remained virtually unchanged year on year due to a decrease in demand for use in telecommunications equipment and automotive electronic components, despite an increase in demand for use in medical equipment.

The recent declines come on top of earlier ones. Back in March, Hitachi Metals reported that for the previous 12 months its revenues in the Magnetic Materials and Applications segment had a full-year decline of 14.8%.

Carpenter Technology, a company not accustomed to being in the red, registered a net loss of $118 million for the three months ended June 30 in reporting its fourth quarter and fiscal year 2020 results. The company manufactures a broad range of soft magnetic and other alloys, along with an aggressively growing capability in additive manufacturing.

Revenues for the most recent three months fell 32% from $641 million for its fourth quarter in 2019 to $437 million this year. For the full 12-month period, the drop in revenues was about 8.5%, falling from $2.38 billion in 2019 to $2.18 billion this year.

“We generated strong free cash flow in the quarter which further strengthened our already healthy liquidity position via a significant reduction in inventory,” said Tony Thene, president and CEO. “The strategic decision to accelerate our inventory reduction plan to drive cash flow negatively impacted our operating results in the quarter. We also continue to deal with the incremental operating costs and reduced productivity associated with COVID-19 and its impact on our operations.”

“Our facilities remain open which speaks to the dedication of our employees and the benefit of our core safety values. Demand patterns have been broadly impacted by Covid-19 and we are working closely with customers across our end-use markets as supply chains continue to adjust. While Covid-19 has created headwinds for our industry, we have successfully enriched and extended supply agreements with key aerospace, medical and semiconductor customers who recognize the benefits of our advanced material solutions and our demonstrated resilience in being able to safely operate our facilities.”

“While we currently expect demand patterns to remain subdued during the first half of fiscal year 2021, the long-term outlook for our key end-use markets remains strong and our supply chain position remains resilient. We have ample liquidity to navigate the current challenging environment and will continue to actively manage our business and take additional actions if necessary. We believe we will emerge from this crisis with even stronger connections with our customers, as well as increased market share across key aerospace and defense and medical platforms and applications.

Our established core business and leadership in critical emerging technologies including soft magnetics and additive manufacturing continue to support long-term sustainable growth and value creation for our stakeholders.”

Coil winding and electrical manufacturing equipment maker Aumann AG of Germany, generated revenue of €84.7 million in the first half of 2020, registering a dramatic decline from the previous year’s level of €133.5 million. Revenue in its Classic Segment plummeted by 61.4% to €29.7 million, while revenue in its E-mobility Segment fell slightly by 2.9% to €55.0 million. The E-mobility segment’s revenue share was 65.0%.

Due to COVID-19, order intake was weaker than expected in the first half of the year, but at €83.1 million it was still roughly in line with the previous year’s level of €86.1 million, the company said. A positive aspect is that order intake developed well in the e-mobility segment, rising by 10.1% to €41.8 million despite the current challenges, thereby partially compensating for a decline in the Classic segment of 14.4% to €41.2 million.

Management said it expects that its forecast of full-year revenues in the range between €180 and €200 million and a positive margin of up to 5% will be reached at the lower end of each range. This is based on the expectation that the economy, after the economic low point in the second quarter of 2020, will slightly recover in the further course of the year and that the COVID-19 pandemic will not worsen further.

Standex International, based in Salem, NH and parent company of Standex Electronics, Agile Magnetics and Renco Electronics, reported a company-wide decline in revenues of 17.4% for the recent quarter, dropping from $168.7 million a year ago to $139.4 million this year. The 12-month tally was 5.5% decline from $639.9 million for the full year ago compared to $604.5 for the fiscal year just concluded.

For its electronics segment which includes the magnetics business, the recent quarter’s revenues fell from $49.7 million to $44.8 million, a 10% decrease in revenue from its fourth quarter a year ago as both North American and European markets reflected weakness in end markets due to the economic impact of the pandemic. The decline was partially offset by a modest recovery in Asian end markets.

Looking ahead, the company said it expects an increase in revenue due to positive trends in its existing magnetics product line as well as a contribution from the recently closed Renco acquisition in fiscal first quarter 2021. It also anticipates improvement in operating margin reflecting continued cost and productivity initiatives combined with limited incremental impact from sequentially flat reed switch raw material costs.

“I am very proud of the performance of our employees in this very challenging environment. They displayed great dedication, creativity and resilience to safely deliver on customer commitments. Our global teams continue to collaborate at a high level. I believe Standex will exit this environment as a stronger company,” commented David Dunbar, president and CEO.

“Overall, fourth quarter results were largely in line with our expectations. Since the end of April, our end markets have exhibited a gradual increase in the level of customer activity that has continued into our first quarter. Besides continued steady free cash flow generation in the quarter which further contributed to our financial strength, we remained very active in transforming the portfolio.

“In July, we announced the acquisition of Renco Electronics, a leading U.S.-based custom magnetics manufacturer. Renco is a great fit deepening our significant engineering and technical expertise as well as providing us with a highly complementary customer base and end markets. We expect Renco to be accretive to our earnings in fiscal 2021 and additive to consolidated free cash flow.”

For TDK, the Japan-based global provider of electronic components and ferrite materials, the company’s first quarter ending June 30, saw an 8.1% decline in revenues from $3.0 billion a year ago to $2.8 billion this year. Profit declined 15% from $140 million to $122 million.

During the first three months of fiscal 2021, the global economy was adversely affected by the COVID-19 becoming a pandemic and a severe worsening in relations between the U.S. and China, the company related. The electronics market, which has a large bearing on the consolidated performance of TDK, was significantly affected by these events. Production volume in automobiles, smartphones, and hard disk drives was substantially lower than the previous year. On the other hand, demand expanded for notebook PCs and tablets as more people worked and studied at home. Demand grew strongly for fifth-generation mobile communication system (5G) base stations, especially in China, where infrastructure is being proactively upgraded.

Breaking things down by business sector, its magnetic applications segment experienced a 31% drop in revenues to $354 million. Sensor applications segment fell 19% to $136 million. Passive components which includes inductive devices fell 14% to $781 million.