The rare earths industry is at a turning point, as new sources of supply come on stream, industry in China consolidates under a limited number of state owned enterprises, and consumers re-evaluate the way in which rare earths are used after a period of unprecedented high prices.

Measures taken to control production in China are becoming more effective, resulting in a decline in official production of more than 4%py from 2006 to 2011. In 2011, China accounted for 94 percent of world production and this is expected to fall to just over 70 percent by 2015. An increasing proportion of Chinese supply is now required for its domestic industries which will account for 70 percent of total demand for rare earths in 2011. New projects in the rest of the world are forecast to contribute an additional 56,000 to 57,000t REO to supply by 2015.

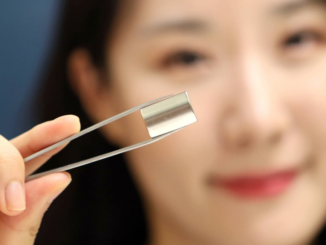

All the growth in demand between 2005 and 2010 came from China (11%py); growth in the rest of the world fell by almost 4%py, largely a consequence of the global economic downturn in 2009 and a tightening of the Chinese export quota in 2010, which restricted availability. In the years to 2015, the main demand driver will be the use of rare earths in NdFeB magnets, which are forecast to grow at 11-13%py as potential markets expand to include applications in permanent magnet motors for electric vehicles and wind turbines. Magnets could account for nearly one third of demand by 2015. Strong growth in demand is also forecast for rare earths in NiMH batteries, phosphors, optical glass and ceramics.

From June 2010, when the Chinese export quota fell by nearly 40 percent, prices for most rare earths began to rise sharply, particularly for the lower cost LREEs where traders limited sales in order to maximize exports of higher value HREEs. Prices for those rare earths used in magnet alloys also rose rapidly in response to strong demand within China. At the start of Q4 2011, prices underwent some correction but are still at a level that has caused end users to look at reformulation, alternative technologies and recycling.

For more information or to order this report visit www.roskill.com/rare-earths.