Neo Performance Materials reports a 21% drop in revenues and a 10% volume drop for its Magnequench business unit over the nine months ending September 30. Considered a bellweather for the market in rare-earth magnetic powders, Magnequench is the world leader in the production of magnetic powders used in bonded and hot-deformed, fully dense neodymium-iron-boron (NdFeB) magnets.

Magnequench accounted for 42% of the company’s revenues for the period, amounting to $131 million of Neo’s $312 million in total revenue. The Magnequench revenues declined $35 million from their level of $166 million for the same period in 2018.

There were no surprises from what it expected, however, said Neo. Volumes decreased mostly in its legacy and longer running programs, due to the slowdown in auto sales, slower economic performance in certain sectors, and anticipated customer inventory adjustments. The company continues to see growth related to its newer Magnequench products including traction motors for hybrid and electric vehicles as well as programs that are still ramping up volumes to full production levels. The company says it is benefiting from growth in the precision and efficient motors and the increased utilization of its magnetic materials on a per-vehicle basis, a continuing growth trend driven by a larger global macro trend toward increasing electrification of various vehicle systems.

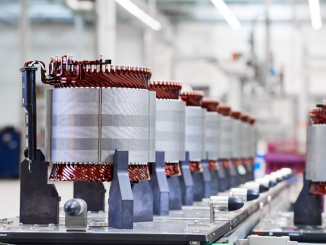

With over 30 years of manufacturing experience, Magnequench uses a proprietary process to manufacture its powder using a blend of rare earth oxides as the primary input. The powders are used in the production of bonded permanent magnets that are components in automotive motors, micro motors, traction motors, sensors and other applications requiring high levels of magnetic strength, improved performance, and reduced size and weight.

Based in Toronto, Neo has become as a global leader in the innovation and manufacturing of rare earth- and rare metal-based functional materials. The company has approximately 1,859 employees spread across a global platform that includes 11 manufacturing facilities located in China, USA, Germany, Canada, Estonia, Thailand and South Korea as well as two dedicated research and development centers in Singapore and the UK.

Neo is the only non-Chinese company with a license to separate rare earth elements in China, which provides unique competitive advantages and a degree of vertical integration. Since 1994, the company has leveraged its rare earth separation expertise to innovate and grow into a leading manufacturer of functional engineered materials for specialty end markets.

For more info, see www.neomaterials.com.