Luxfer Holdings PLC, and Neo Performance Materials Inc have announced that their agreement under which Luxfer would have acquired the Canadian rare-earth and rare-metals leader for $612 million has been called off. No reason was given for the termination. Under the agreement, Luxfer would have been a nearly $1 billion operator with a diverse portfolio of advanced materials serving industrial, defense, emergency response, healthcare and automotive markets.

“Neo’s magnequench segment is an industry leader in rare-earth powders used to manufacture magnets for performance micro motors and other critical applications, while the chemicals and oxides segment complements Luxfer’s own zirconium-based chemicals business.” stated Alok Maskara, CEO of Luxfer, when the agreement was announced in December.

The transaction would have aided Luxfer’s strategy to become a leading global manufacturer of highly-engineered advanced materials for high-end applications, said the company. The acquisition would have also expanded Luxfer’s access to high-growth Asian markets, diversifying its customer base and creating a more direct path to procure raw materials.

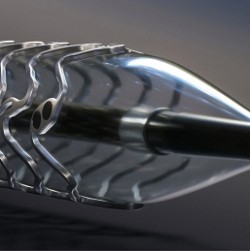

Based in Manchester, UK, Luxfer is a producer of highly engineered materials with five business units focused on magnesium, zirconium and other materials. The company posted revenues of $441 million in 2017. Pictured above is Luxfer’s speciality magnesium alloy.

According to Geoff Bedford, CEO of Neo Performanc Materials, “The combination of Luxfer and Neo creates a global leader of highly-engineered advanced materials which are critical to many of today’s macro global trends, including those promoting energy efficiency and environmental sustainability. This combination will enable our businesses to reach the next level as an important part of a larger, more diversified company.”

On March 11, one day after the deal termination was announced, Neo reported solid financial results for 2018 with revenues rising 4.6% to $454 million and a $41 million profit for the year. A week later, the company issued a statement that it was preparing for a re-purchase plan of its stock. “Neo believes that its shares have been trading in a price range which does not adequately reflect the value of such shares in relation to the business of Neo and its future business prospects. As a result, depending upon future price movements and other factors, Neo believes that its outstanding Shares may represent an attractive investment to Neo,” the company said.

Neo’s business is organized along three segments: Magnequench, Chemicals & Oxides and Rare Metals. Neo is headquartered in Toronto, Canada with corporate offices in Greenwood Village, Colorado, and in Beijing, China. It operates globally with sales and production across 10 countries, being Japan, China, Thailand, Estonia, Singapore, Germany, the UK, Canada, USA and South Korea.

For more information, visit : www.luxfer.com