Despite traumatic slowdowns and shutdowns due to the Covid-19 pandemic, the market for electrical steel is pointed upward over the long term. Recent reports by market analysts differ somewhat on their estimates of the market size but all register solid rates of growth — albeit with most of the analyses reflecting pre or mid-pandemic data. Ironically, despite the current pressures, there are some indications that the pandemic may actually trigger more growth in demand for electrical steel as a result of accelerating electrification market forces.

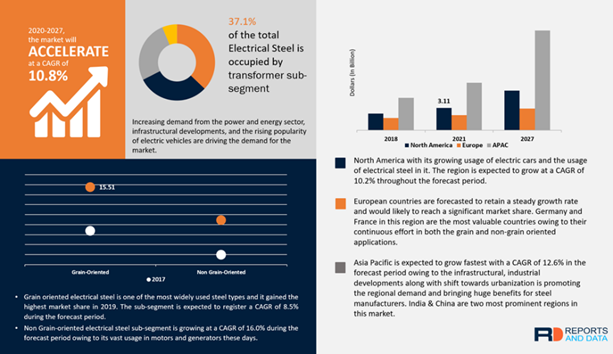

Shown above is a summary sheet from the study by Reports and Data, published in June. It projects the global electrical steel market to grow at a rate of 10.8% from $10.8 billion in 2019 to $24.4 billion in 2027. The major factors contributing to this growth is the increase in investments in infrastructure development and urbanization across the world. There is a surge in demand from energy generation and transmission sector and the introduction of electrical vehicles is largely driving the industry’s growth.

It defines electrical steel as a special type of steel that is produced by altering certain magnetic properties of steel and is used in the manufacturing of a number of devices like generators, power transformers, inductors, and others. Silicon, when added to electrical steel, is known as laminate steel and is used in the lamination process in the core of electrical components.

As the Covid-19 crisis has grown, says the report, major players in the electrical steel industry are trying to reanalyze their strategies and trying to sustain in such a difficult situation. The pandemic had forced many end-use industries like automotive, construction and infrastructure to stop their production as well as delay their expansion plans which has greatly hurt the industry.

Some other key findings of the study by Reports and Data are:

Grain oriented electrical steel is one of the most widely used steel types and it gained the highest market share in 2019. The sub-segment is expected to register 8.5% growth during the forecast period. This variant of electrical steel helps in improving performance of transformers by reducing their weight and increasing their efficiency. The products under this sub-segment contain large sized grains which reduces hysteresis loss and thus used in transformers and power generators. The increase in demand of energy and power is likely to drive the segment’s growth.

Transformers are one of the largest application segment in the industry with a market share of 37.1% in 2019. The sub-segment is predicted to have a growth of 11.6% during the forecast period. Large power transformers and distribution transformers utilize grain oriented electrical steel and they are needed for their high power efficiency and ability of transmitting power through long distances. The growing infrastructural and industrial development along with the increasing demand of power is driving the segment. These products have high efficiency, low magnetic losses and ability of supplying power to remote locations.

Automobile industry holds one of the most significant consumer base of electrical steel. It is predicted that this sector is likely to grow 12% during the forecast period. The products of the industry enhance efficiency and productivity of automobiles. They also improve the visual appearance of vehicles which increases resale value of vehicles. This type of steel is resistant towards corrosion and makes cars lightweight as well as maintaining safety standards. The introduction and growing popularity of electric vehicles is also likely to drive the industry’s growth for a long time.

Regionally, North America is the largest consumer of electrical steel with a revenue share of 28.7% in 2019. The region is expected to witness a growth of 10.2% during the forecast period. Countries like USA, Mexico and Canada are mainly contributing towards these figures owing to the increase in demand of automobile and electric vehicles in these countries. The products in the industry helps to minimize energy losses, increase efficiency and results in decreased fuel consumption. The infrastructural, industrial developments along with shift towards urbanization is promoting the regional demand and bringing huge benefits for steel manufacturers.

In a report available from Markets & Markets, the global electrical steel market size is estimated to be $31.5 billion in 2020 and projected to reach $45.9 billion by 2025, growing at a rate 7.9% from 2020 to 2025. “However, the recent outbreak of Covid-19 is expected to have a severe impact on the electrical steel market,” the authors note.

According to a report by Quince Market Insights, the global electrical steel market is estimated at $25.3 billion in 2019 and expected to reach $45.7 billion by 2025, growing at a rate of 6.8% during the forecast period. The increasing urban population worldwide combined with the increased availability of electricity in developing countries is expected to drive the market.

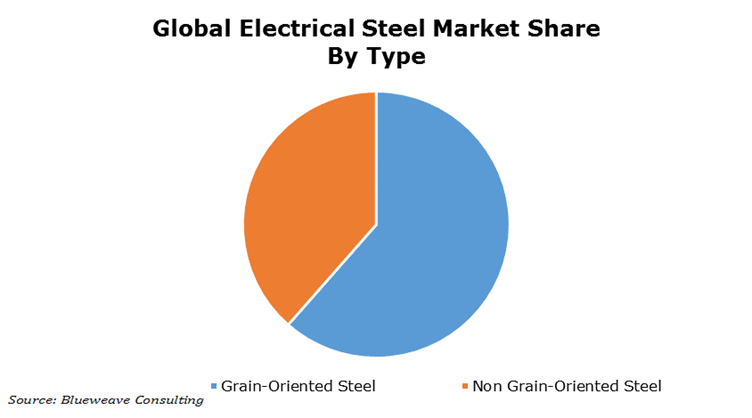

In a report from BlueWeave Consulting, researchers estimate the global electrical steel market reached $32.9 billion in 2019 and is expected to reach $48.9 billion by 2026, growing at a rate of 6.8% during the forecast period. Growing demand for motors in electric vehicles is estimated to remain a major driving factor.

Based on type, the electrical steel market segments broadly into grain-oriented steel and non grain-oriented steel, notes BlueWeave. Among various product types, grain-oriented steel is estimated to dominate the electrical steel market during the forecast period due to its rising demand from transformers cores used in transformers and large generators. It is an iron-silicon alloy with silicon level of 3%. It is used in various forms, such as wound, laminated, and punched sheets. Properties of it are low core loss and high permeability which make them suitable in enhancing the performance and efficiency of transformers and generators.

For more info, see www.reportsanddata.com, www.marketsandmarkets.com, www.blueweaveconsulting.com and www.quincemarketinsights.com.