Northern Minerals Ltd, one of the few producers of rare earth minerals outside China, and steel company Thyssenkrupp have made an offtake agreement whereby Thyssenkrupp will purchase 100% of the output from Northern’s Browns Range Pilot Plant in northern Australia. The companies are also pledging to work together to expand the operations at the project.

A key project that Northern Minerals is working on is to develop new technology for onsite separation that would further distance its capabilities from the predominance of China in the supply chain. A set of tests on its processed material is being performed by K-Technologies in the U.S. Meanwhile, buoyed by recent promising results, the company is continuing new exploration drilling at its property.

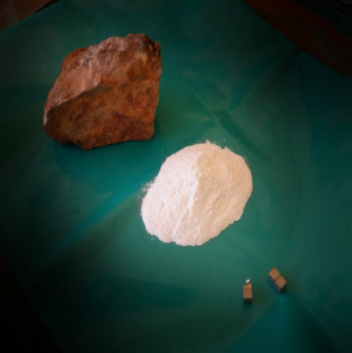

The agreement with Thyssenkrupp Materials Trading Gmbh covers the purchase of all heavy rare earth carbonate from the pilot plant project, a bag of which is shown above, with the flexibility for Northern Minerals to supply heavy rare earths as separated products in the future. It includes all stockpiled product and future production. It replaces an earlier deal with with Lianyugang Zeyu New Materials Sales Co Ltd, which has been terminated, said Northern Minerals.

“The new offtake agreement with a global player such as thyssenkrupp is a significant endorsement of Browns Range and our company,” said George Bauk, managing director and CEO of Northern Minerals which is based in West Perth. “The continued shift of new car sales to electric vehicles is gaining traction, with all major carmakers introducing EV variants of existing models over the coming years. With this shift, both car and component makers are accelerating plans to invest further down the production chain in order to secure surety of supply.”

“Importantly for Northern Minerals,” noted Bauk in August when the deal was struck, “the new agreement doesn’t include any price caps, giving the company full exposure to increasing Dysprosium and Terbium prices, which are up 60% and 35% respectively over the year to date.”

Wolfgang Schnittker, CEO of Thyssenkrupp Materials Trading, commented, “Northern Minerals is one of the few suppliers of rare earths outside China, so we are really looking forward to a successful collaboration between the companies. As the exclusive marketer of these high-quality products we have the opportunity to strengthen our customer relationships long-term and expand our positioning in this field.” Thyssenkrupp Materials Services, the holding company of thyssenkrupp Materials Trading, is the biggest materials distributor and service provider in the western world with around 480 locations including 271 warehouse sites in over 40 countries.

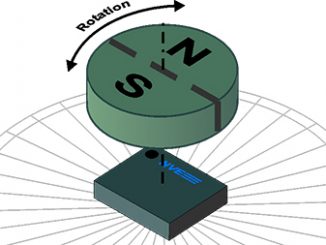

Through the development of its flagship project, Northern Minerals aims to build its Western Australian operation into the first significant world producer of dysprosium outside of China, said Bauk. The project is fully owned by Northern Minerals and has several deposits and prospects containing high value dysprosium and other heavy rare earths. Dysprosium is an essential ingredient in the production of DyNdFeB (dysprosium neodymium iron-boron) magnets.

Meanwhile, the company is proceeding with further exploration drilling and testing its separation technology. A new round of further exploration drilling, shown in the accompanying photo, began in September.

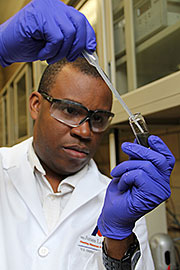

Shortly after the Thyssenkrupp deal was struck, Northern Minerals announced that it has retained USA-based K-Technologies, Inc. to conduct testing of material processed through the separation technology it has developed. If adopted, it would allow Northern Minerals to produce separated rare earth oxides, including dysprosium oxide and terbium oxide for sale directly to permanent magnet makers globally, rather than a mixed heavy rare earth carbonate that currently requires separation in China.

For the “scoping study”, Northern Minerals is sending intermediate mixed rare material to K-Tech’s laboratory in Florida for bench scale separation and purification test work. It will look at the yield potential of targeted rare earth elements and include an estimate of associated operating and capital costs, said Bauk.

K-Tech was selected, he explained, for its capabilities including process technology, know-how and development for the minerals and chemicals industries. K-Tech has focused on various separation processes involving continuous ion exchange, continuous ion-chromatography and related advanced separation methodologies as they apply to a variety of chemical and environmental applications. Its low-cost and environmentally safe separation and purification methodologies have been successfully tested and confirmed in various industries around the world including applications in phosphates, potash, and rare earths, he said.

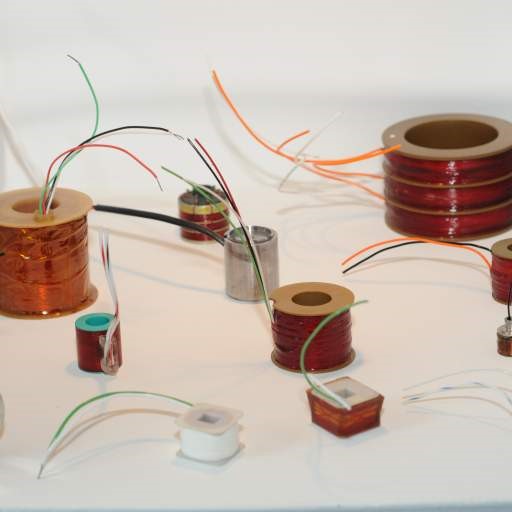

Based in Blasdell, NY, K-Tech also provides electromechanical engineering and product development services in aerospace, defense and industrial markets. Among its manufacturing services are precision winding and the production of high-volume coils and solenoids as well as potting, encapsulation and conformal coating of electromechanical components. It also provides custom cables for military ground-based and Navy applications, specializing in high-reliability cables and wiring harnesses.

If the test results are positive, then Northern Minerals intends to undertake a pilot testwork program and install the technology at Browns Range to assess the feasibility of selling this differentiated product to an end user customer base. “The Pilot Plant Project at Browns Range is all about understanding the potential to become a globally-significant heavy rare earth producer,” said Bauk. “The investigation of separation technology is a natural extension of the existing pilot plant studies.”

Northern Minerals joined the exclusive ranks of being a producer of rare earths in late 2018 when it accomplished its first output of rare earths carbonate at the plant it commissioned in June 2018. Its progress was summarized in June in an investment advisory report by Hallgarten & Co, a New York City investment advisory firm which specializes in the natural resources market.

According to the report, both the beneficiation and hydrometallurgical circuits having now been load commissioned and the focus for commissioning will now be to progress to steady continuous operation of these circuits. In 2016 the company enunciated a three staged production plan, however since that time the plan has become more fluid with a gradualist modular approach rather than a series of quantum leaps. Stage One envisaged the construction of a 72,000 tons per year pilot plant operation at the project though a run-rate of 60,000 tons per year is often cited for actual operations when factoring in weather and maintenance.

Construction of the production facility moved ahead swiftly and was completed mid-2018. The operation as currently constructed represents an investment of $48 million. Previous offsite testwork has shown that its processes can deliver superior recoveries of 87 to 92%.

Mining operations began in the third quarter of 2017 and ended in November 2017 with material sourced from relatively shallow pits at the company’s Wolverine and Gambit West deposits. The tonnage mined was slightly over 200,000 tons, higher than the target of 172,080 tons, providing the company’s stockpile for its processing operations.

For more information, visit: www.northernminerals.com.au; www.thyssenkrupp.com; www.k-technologies.com; www.hallgartenco.com.

.