DuPont recently signed an agreement to acquire Laird Performance Materials from Advent International. DuPont, a global innovation leader in technology-based materials and solutions, intends to strengthen its position in advanced electronic materials for key markets including smart/autonomous vehicles, 5G telecommunications, artificial intelligence, internet of things, and high-performance computing.

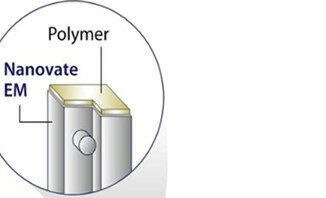

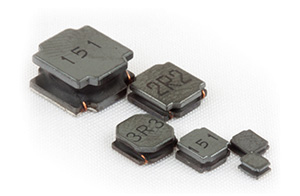

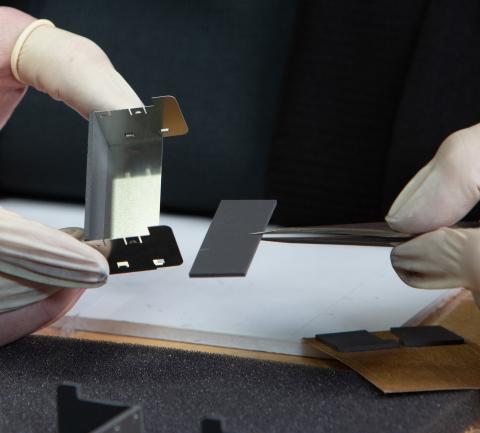

The transaction brings together DuPont’s technology portfolio in films, laminates, and plating chemistry with Laird Performance Materials’ electromagnetic shielding and thermal management solutions. With a best-in-class innovation and product portfolio, the combined organization will be a leader in rapidly growing advanced electronics applications supporting smart/autonomous vehicles, 5G telecommunications, artificial intelligence, internet of things, and high-performance computing. Strong capabilities in material science and application engineering along with an expanded customer base are expected to significantly increase customer speed to market, create new efficiencies in development of multi-functional solutions, and provide high value next-generation products that will deliver incremental revenue synergies over the next several years. DuPont will be uniquely positioned to engage across value chains to address the increasingly complex challenges leading OEMs face in thermal management, signal integrity, miniaturization, power management, and reliability.

Shonnel Malani, a Managing Director at Advent International, stated, “Laird Performance Materials is an outstanding business. Following a strategic refocus and investment in the company’s product offerings and talent, the business has achieved strong growth. We believe that DuPont will be an excellent partner for Laird Performance Materials. The combined organization will be ideally placed to provide customers with a unique and broad range of comprehensive and innovative solutions.”

DuPont expects to realize approximately $60 million in pre-tax run-rate cost synergies by the end of 2024 with the majority realized in the first 18 months post-closing. The estimated one-time cost to achieve these synergies is approximately $40 million. After adjusting for one-time costs and deal-related amortization, DuPont expects the deal to be accretive to its operating EBITDA margins, free cash flow, and adjusted EPS within the first 12 months and to achieve high single-digit ROIC by year five. The enterprise value multiple of the transaction is approximately 15x estimated 2021 EBITDA on a stand-alone basis and approximately 11x including cost synergies.

“This transaction represents another strategic step forward in sharpening our focus and directing our investments towards high-value, high-growth opportunities. We remain committed to a balanced capital allocation policy that delivers strong returns to shareholders and includes organic growth, targeted M&A, and shareholder remuneration,” said Ed Breen, Executive Chairman and Chief Executive Officer of DuPont.

Laird will be able to address and resolve increasingly complex challenges involving thermal management, signal integrity, miniaturization, power management, and reliability. We are confident that the combination of two companies’ technical strengths can, over time, further enhance the capabilities we are able to provide.

The transaction is expected to close in the third quarter of 2021, subject to regulatory approvals and other customary closing conditions.